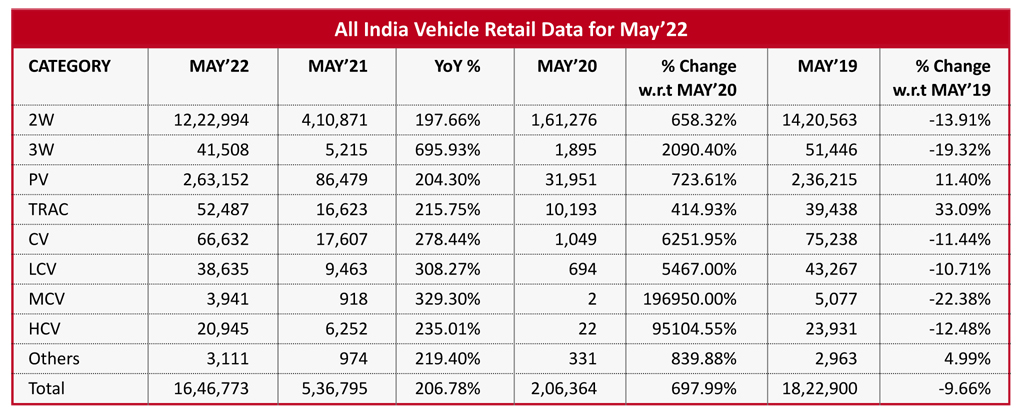

Automotive retail has still not recovered from the jitters of the pandemic. When compared with May 2019, total vehicle retail was down by -10%. Except PV and tractor which continues to show growth of 11% and 33%, all the other categories like 2W, 3W and CV fell by -14%, -19% and -11%, respectively

The Federation of Automobile Dealers Associations (FADA) has released vehicle retail data for May 2022. On a YoY basis, total vehicle retail for the month of May increased by 207%. All categories were in green with 2W, 3W, PV, tractors and CV up by 198%, 696%, 204%, 216% and 278%, respectively.

However, automotive retail has still not recovered from the jitters of the pandemic. When compared with May 2019, total vehicle retail was down by -10%. Except PV and tractor which continues to show growth of 11% and 33%, all the other categories like 2W, 3W and CV fell by -14%, -19% and -11%, respectively. The Government’s reduction in fuel prices will tame inflation and boost vehicle sales, especially 2W, but the increase in third party insurance premiums will act as a deterrent for the 2W customers to come forward and conclude their purchase decision.

While the Russia – Ukraine war continues to fuel chip shortage, the Reserve Bank of India (RBI) has warned of more inflation as the increase in wholesale prices will get passed to the consumer, thus decreasing his or her disposable income.

Meanwhile, with FADA’s persistent follow up with the Andhra Pradesh Transport Ministry, the state has now migrated vehicle registration to Vahan. While this has happened towards the end of May, full month numbers will only come later. The only states remaining are Telangana, Madhya Pradesh and Lakshadweep. With this, Vahan now covers 91.6% RTOs across the country.

Commenting on how May performed, FADA President Vinkesh Gulati said, “The Indian automotive industry during May continued its flattish run for the third consecutive month. While YoY comparison with May 2021 shows exceptionally healthy growth rate across all categories, it is important to note that both May 2021 and May 2020 were affected by nationwide lockdown due to the pandemic. Hence, a better comparison will be with May 2019 which was a normal pre-pandemic month.”

Lacking in Momentum

Similar to last month, May 2022 when compared to May 2019 reveals that automobile retail is still not on a growth trajectory as overall retails were down by -10%. While PV and tractors continued a positive run by growing 11% and 33%, respectively, 2W, 3W and CV are yet to show any signs of healthy run rate (compared to pre-pandemic months) as they de-grew by -14%, -19% and 11%, respectively. “The government made a bold decision to cut excise duty on fuel prices, thus reducing inflation and economic distress. While this will have a positive rub-off on sale of vehicles, especially 2W, the increase in third party insurance premium will act as a deterrent for some,” FADA stated. The 2W segment has seen slight improvement in overall sales when compared with April 2022.

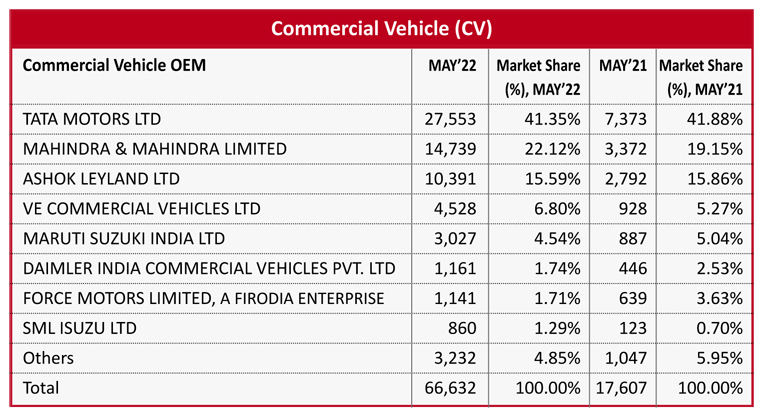

While 2W EV sales were growing rapidly though on low base, various fire incidents across almost all EV brands have created fear in the minds of the customers. This coupled with supply chain issues has decreased 2W EV sales drastically from last month. The PV segment which has already surpassed the May 2019 numbers is witnessing a huge demand. Dealers are not able to fulfil the same due to supply side issues. This has not only led to an increase in waiting period ranging from three months to two years but is also keeping the customers frustrated. Healthy booking and single digit cancellation shows that demand may stay put even when normal supply resumes in months to come. The CV segment, especially buses, is showing good demand due to re-opening of educational institutions.

Near-Term Outlook

While the Russia – Ukraine war continues to create demand supply mismatch, thus delaying the availability of PVs, RBI has warned of more inflation as the increase in wholesale prices will get passed on to the end consumers. This will result in a lower disposable income which will ultimately hamper automobile sales. RBI’s observation has come at a time when the WPI Index rose by record 15.1% in the wake of high commodity prices and the impact of the breakdown in supply chains due to the war and the strict lockdown by China. FADA hence continues to remain cautious for any further recovery in automobile sales in the near term.