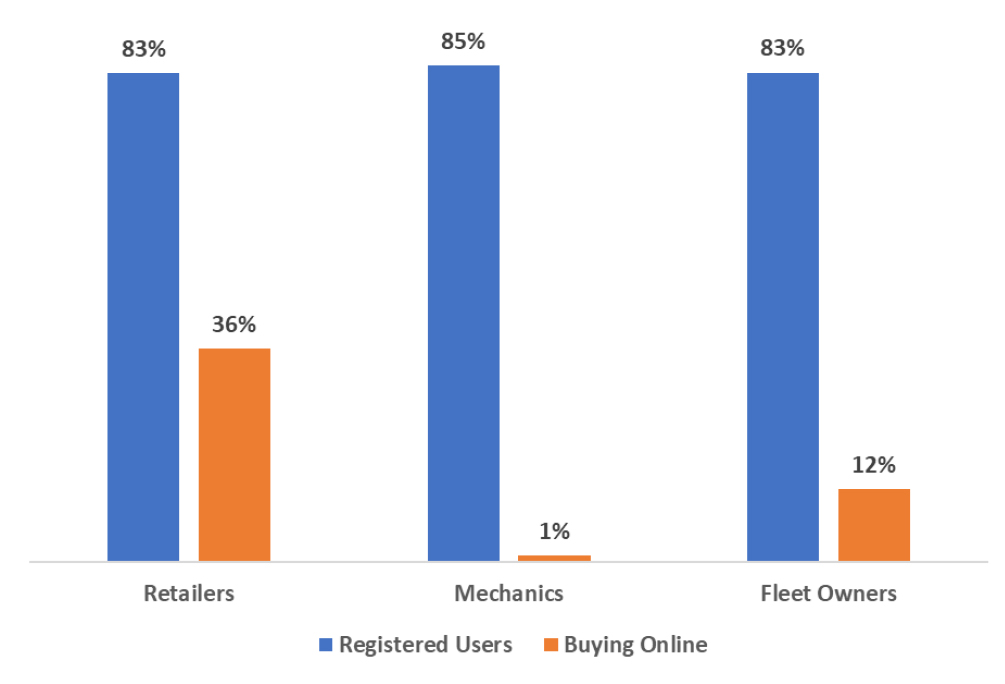

The e-commerce pie in the commercial vehicle automotive component market is definitely growing. Currently, 83% of the retailers are registered online of which 36% retailers are ordering online.

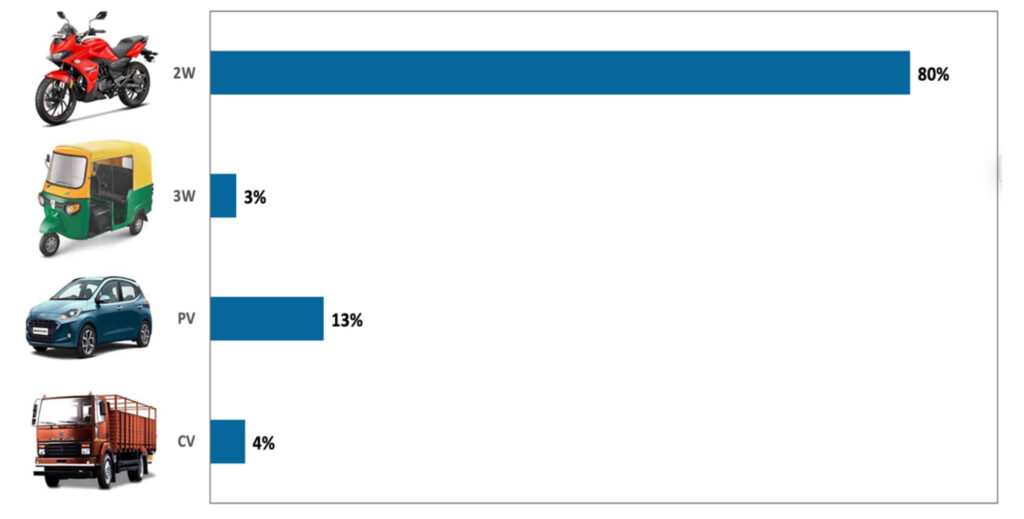

India is one of the leading manufacturers and exporters of commercial vehicles in the world. And commercial vehicles hold almost 4% of the total market share of all vehicles sold in the nation. This is in comparison to 13% market share for passenger vehicles, 3% for three-wheelers and a massive 80% held by two-wheelers.

Component Aftermarket Potential

The overall automobile aftermarket has clocked sales worth Rs 64,509 crore in FY21. The breakup is as below:

- Commercial vehicles accounted for Rs 22,710 crore, which was 35% of the overall sales. Passenger cars clocked Rs 21,816 crore, which was 34% of the overall sales.

- Two and three-wheelers together accounted for Rs 13,841 crore, which was 21% of the overall sales.

- The tractor segment accounted for Rs 6,412 crore worth of sales, which was close to 10% of the overall sales.

After understanding the break up of the sales in FY 21, we can conclude that 4% of the vehicles sold in India contributed towards a major chunk of sales in the automotive aftermarket industry. Also, the automobile aftermarket business is estimated to grow to Rs 74,185 crore in FY22, indicating 15% growth.

E-Commerce Scenario in CVs

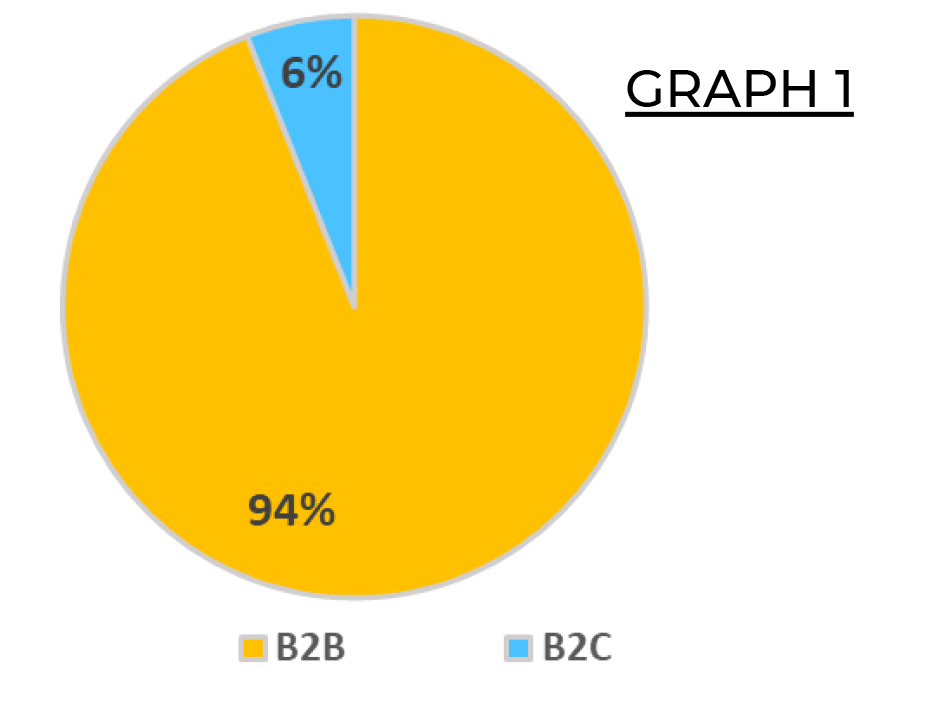

In the commercial vehicle segment, 94% of the e-commerce market is dominated by the B2B segment, and the remaining 6% is captured by the B2C segment. This was less than 1% of the overall CV aftermarket in FY21 sales, and has the potential to grow to Rs 1,000+ crore by capturing 3% of the total aftermarket sales by FY28.

Retailers accounted for 94% of B2B sales. [GRAPH 1] Out of 6% of B2C sales, mechanics were 1% and fleet managers were 2% of the customer base. The remaining 3% were others who can be direct consumers.

User Penetration

Currently, 83% of the retailers are registered online and out of this 36% retailers are ordering online. Up to 85% of the mechanics are registered online and out of 85%, around 1% of mechanics are ordering online. Further, 83% of the fleet owners are registered online of which 12% are ordering online. The word ‘registered’ mentioned above gives an idea of the stakeholders who are constantly using OEM and part manufacturers’ application or website through their registered mobile numbers or customer ID provided by the seller or GST number. The user ordering penetration will be increasing significantly in the upcoming years.

The stakeholders are sub-categorised as under:

Retailer

- Company Owned Retail Shop: Operating with exclusive company products with design and SOP. Up to 95% of the retail shop owners are registered online.

- A Class: Sellers categorised based on purchase on monthly basis. They settle the payment within the commitment date and those are eligible for TOD. Up to 87% of A class retailers are registered online.

- B and C Class: Based on the purchase amount they are categorised under B or C. Up to 78% of B class and 70% of C class retailers are registered online.

Some of the other sub-categories of stakeholders, apart from retailers include:

Mechanic

- Mechanics (A, B and C) are defined based on the vehicles attended per month for repairing. A maximum number of A and B class mechanics are trained by the OEMs and component manufacturers and possess good product knowledge.

- Further, 94% of A class, 85% of B class and 75% of C class mechanics are registered online and check catalogues and technical details periodically.

Fleet Owner

- Fleet owners are classified under A,B and C classes based on the fleet numbers. A class fleet owners are the ones with their own garages such as VRL, KPN, etc. B class fleet owners have their own mechanics and C class fleet owners get their vehicles repaired from outside mechanics.

- Further, 92% of A class, 82% of B class and 75% of C class fleet owners are registered online.

The Online Buying Trend

The relation between retailer and distributor dates back several decades. If the retailer informs the distributor over the phone, the part will be delivered the same day with a credit period and the distributor will give TOD once every year. The advantages of this process include same day delivery and availability of credit and TOD. And yet, why do stakeholders order online?

There are certain specific advantages:

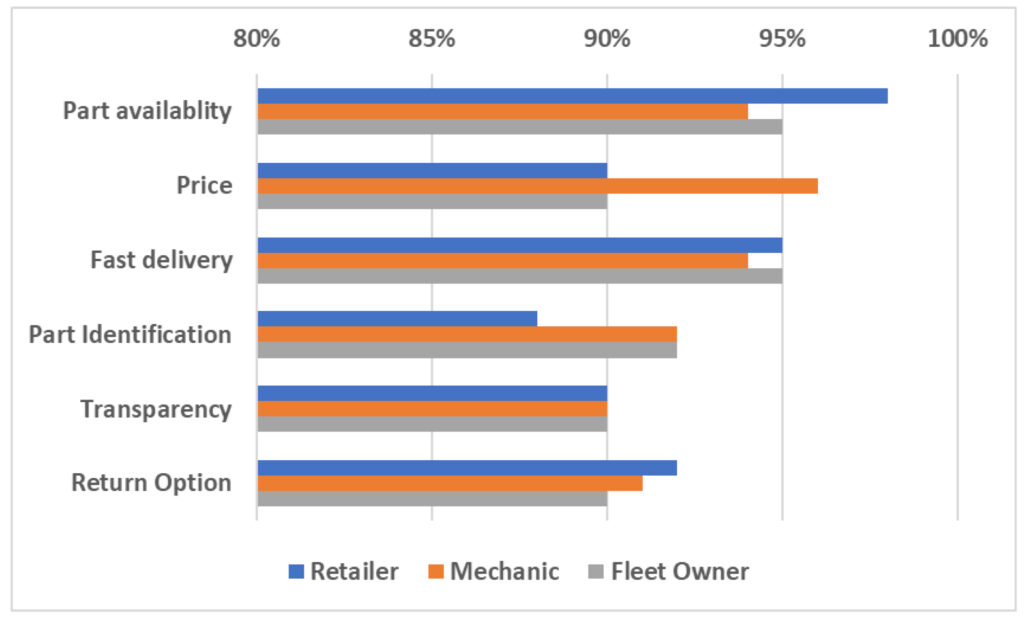

- Parts Availability: Let’s say an OEM has 1 million SKUs of which a distributor can keep a stock of maximum 5,000 SKUs. Those 5,000 SKUs probably are only the fast moving items which will be available anywhere easily. But accidental parts, critical parts, new products, vehicle on road parts are very difficult to get. Thus, part availability is the primary reason for customers to buy the parts online.

- Faster TAT (Turn-Around Time): Stakeholders expect the order to be fulfilled on a committed date without any postponement. If the seller fails to fulfil the order, the retailer will lose confidence and it is very difficult to come on board again.

- Easy Refunds and Tracking: Customers would like to track the orders and in case of any discrepancy the return procedure should be easy with the initiation of full refund within the stipulated time.

- Price: According to retailers, the price does not matter because they want to fulfil and retain their customers. Some retailers would be willing to buy critical parts at MR, in order to serve their customer better. For the mechanics, price is one of the main reasons but not the only reason. A fleet owner is also not bothered about the price because what is important is to get the component quickly so as to keep his fleet running.

- Part Identification: Stakeholders identify the part through catalogues, technical details and images. They might not order online but check these specifications which can convert them into potential customers.

Current Market Players

Currently, Ashok Leyland is the only OEM offering doorstep delivery to its customers through an in-house app called ‘LeyKart’. The company caters to both B2B and B2C clients and the fulfilment model is through its own distribution channel and warehouses.

Such apps are being used by several other OEMs and part manufacturers to cater to their customers and offer facilities such as checking of part numbers, part images, alternate part numbers, part catalogues, new product details, etc. Boodmo is India’s largest and fast growing online marketplace for car spare parts. Currently, it is set to enter the commercial vehicle spare parts’ space and offer a one- stop solution for the purchase of all commercial vehicle spare parts.

Conclusion The future of online commercial vehicles’ spare parts business has the potential to be streamlined through the use of technology and highly dependable logistics network. The market players have to fulfil the demand for critical parts in time and the process should be user-friendly that allows stakeholders to be a part of this disruption in the long run.