Navigating growth amidst structural shifts as India gears up to become a $5 trillion economy, the Commercial Vehicle (CV) industry stands as the lifeblood of national logistics, moving over 65% of India’s freight and contributing significantly to the country’s industrial output and employment. But this journey isn’t without its twists. While growth drivers abound, ranging from infrastructure megaprojects to scrappage policy triggers, the road ahead is also peppered with constraints like inadequate alternate fuel infrastructure, policy flux, and multimodal logistics cannibalization. Let’s explore the twin-engine story of the Indian CV market on what’s powering growth, and what’s testing resilience

With GDP growth projected at 6–6.5% and freight (BTKM) increasing at 4–5% CAGR, the sector is transitioning into a digitally integrated logistics backbone. From core fleet modernization to connected systems and alternate fuel adoption, the industry is recalibrating toward ecosystem-level transformation. This shift is driven by the twin imperatives of efficiency and sustainability.

Market Snapshot

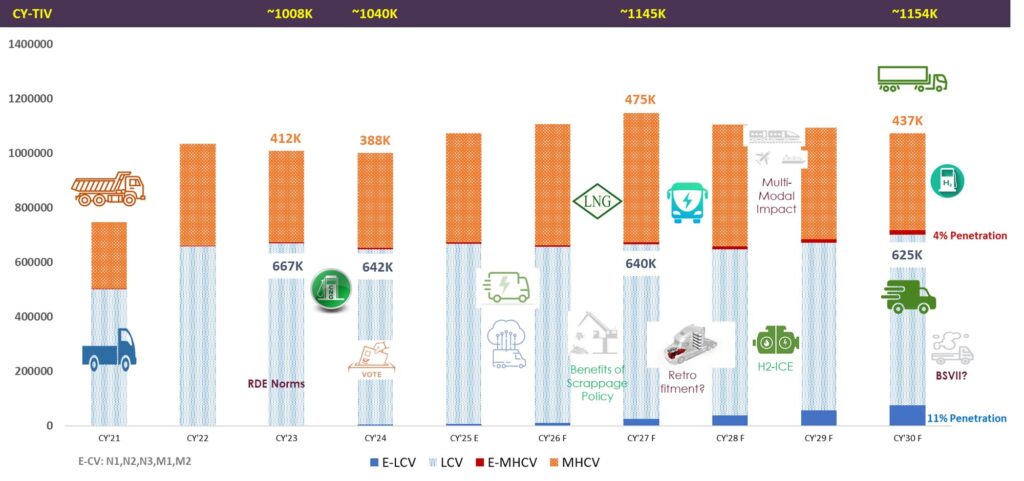

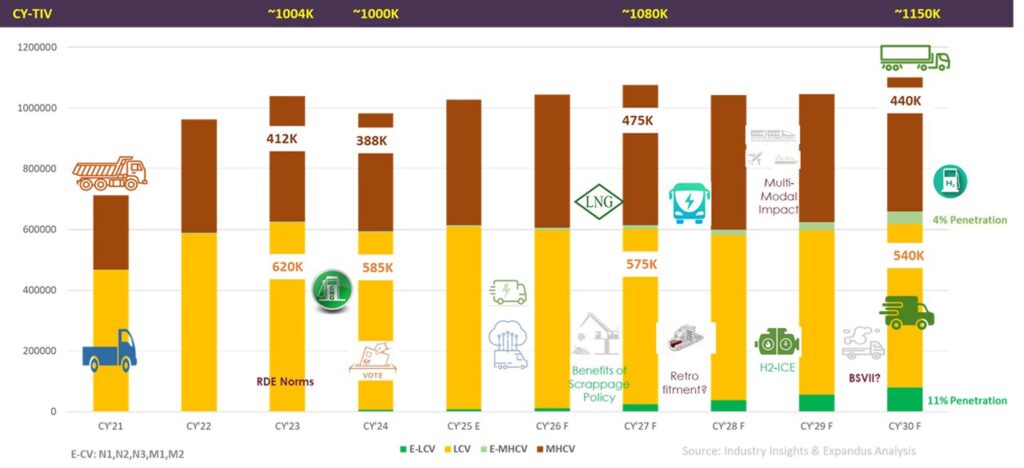

Indian CV industry is entering a Multi-Year, Moderate Growth Phase—one that’s not marked by the steep V-shaped recoveries or sharp cyclic declines of the past, but rather moderate and multi-year expansion supported by structural triggers. Total Industry Volume (TIV) is poised to cross 1.15 million units by end-decade, growing steadily from the ~1-million-unit mark. This is led not by sheer first-time purchases, but replacement demand from ageing fleets, infrastructure-led tipper/haulage demand, and bus modernization programs (especially in state transport and intercity fleet upgrades).

The base volumes are resilient despite elections, emission transitions (BSVI/RDE), and economic volatility, indicating that the CV sector is now closely coupled to India’s core GDP and mobility metrics.

- The scrappage policy and a visible spike in 15+ year-old fleets provide a clear demand anchor.

- Bus volumes are seeing traction with Smart City initiatives, EV adoption by state transport undertakings (STUs), and an uptick in tourism and staff transportation post-COVID.

- Tipper and ICV demand remain sensitive to infra projects, mining, and core industrial output, all expected to stay stable or grow moderately.

As India’s multimodal infrastructure matures with Dedicated Freight Corridors (DFCs), coastal shipping, and air-rail-freight corridors, trucking is facing both opportunity and pressure. The DFC, rail revival, and government push for coastal and inland shipping are expected to shift a small but material share of Class 8 (heavy truck) volumes to rail. As a result, truck tonnage demand may rise, but volume growth may taper in certain corridors where intermodal transport becomes more efficient. OEMs and fleets will need to adapt to this rebalanced logistics model, investing in fleet optimization, digital tracking, and better route-mix management.

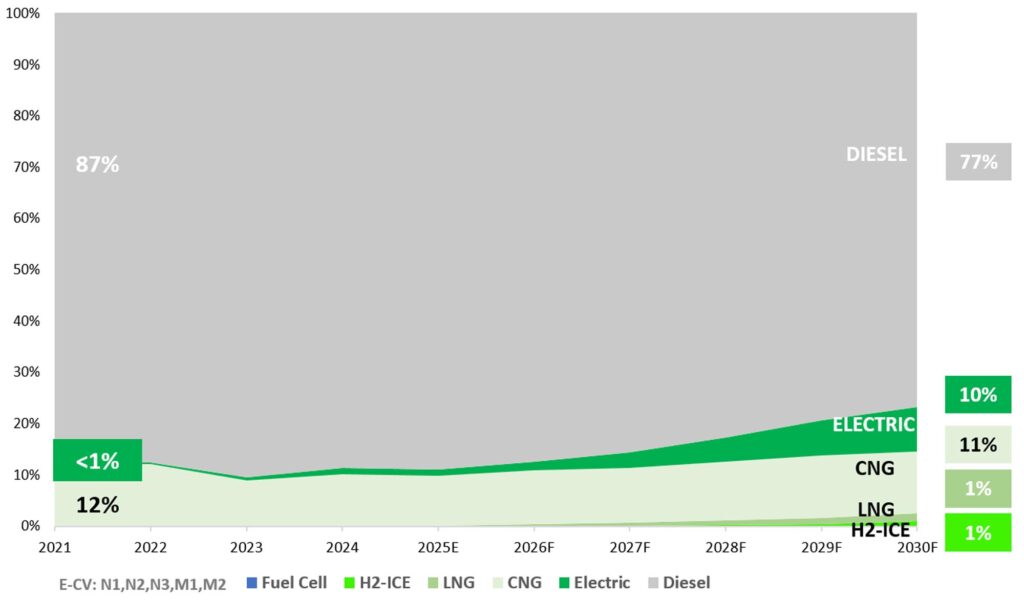

Non-ICE (electric, LNG, hydrogen) penetration remains modest and skewed to specific segments: LCVs (N1) show up to 11% EV penetration by end-decade, mainly in urban last-mile applications. Larger CVs (N2, N3) show just 4% non-ICE penetration, driven more by trials and Fleet-led procurement than market pull. LNG, Hydrogen ICE, and retro fitments remain in experimental or policy-vague zones. OEMs are exploring retro fitment, but concerns around safety, TCO, residual value, and regulatory clarity are slowing mainstream plans.

Growth Drivers & Challenges

| Aspect | Trend |

| Volume Growth | Moderate but sustained (~3–5% CAGR) |

| Key Demand Drivers | Scrappage, infra, bus modernization |

| Alternate Fuel Penetration | 4–11% depending on segment |

| Multimodal Impact | 3–5% rebalancing in heavy trucks |

| Policy Uncertainty Areas | Retrofitment, BSVII, hydrogen infra |

The CV growth is no longer linear and future is “P.A.C.E.”—Polarized, Automated, Connected, Electrified. From Tier-I cities experimenting with electric buses to hinterland tippers resisting EV economics, OEMs must develop multi-modal strategies to address hyper-diverse India.

One of the most pressing challenges is the extreme fragmentation across the CV parts and service ecosystem. Despite contributing significantly to the economy, India’s aftermarket lacks structured digital infrastructure. Most parts data remain unstandardized, SKU discoverability is low, and fitment assurance is unreliable. This hampers e-commerce readiness and increases downtime for fleets. Digitally cataloging parts, linking them with vehicle intelligence, and enabling district-level demand forecasting can unlock significant value. A centralized, AI-enabled aftermarket data layer is not just a tech upgrade; it’s a critical step toward reducing inefficiencies, improving service turnaround, and scaling organized distribution.

Strategic Priorities & Roadmap: The Road Ahead presents broadly five strategic lanes for stakeholders

1. Logistics Transformation: Integrated multi-modal systems, smart tolling, and vehicle platooning to unlock 25% logistics cost efficiency.

2. Localization & Deep-Tech Self-Reliance: Localize parts, electronics, and drivetrain components to de-risk forex and global supply shocks.

3. Digital & Data-Led Optimization: Digital twins, ULIP, resale analytics, and predictive diagnostics are new KPIs for CV TCO.

4. CV Aftermarket E-Commerce: Structure and standardize parts taxonomy to digitize the CV aftermarket—India’s “silent revolution.”

5. Circular Economy for CVs: From scrappage to lightweighting, sustainability will unlock cost savings and second-life material chains.

The Indian CV industry’s next chapter is about adaptation, not disruption. Stakeholders must prepare for a Digitally enabled Data, Tech & AI-driven, sustainability-aware, policy-aligned growth. While ICE and diesel will continue to dominate this decade, the gradual rise of EVs, retrofit discussions, and multimodal logistics will redefine competitive advantage, not in volume, but in efficiency, uptime, and ecosystem integration.

In conclusion, India’s CV industry is poised for long-term structural growth, but it must navigate a series of disruptive shifts. The winners will be those who balance diesel-era scale with digital-era intelligence, driving India’s CV evolution from volume to value.