The vehicle retail data for Dec’23 and CY’23 released by the Federation of Automobile Dealers Associations (FADA) indicates that December 2023 witnessed a 21% YoY growth in auto retail. All categories reported positive growth: 2W by 28%, 3W by 36%, PV by 3%, Tractors (Trac) by 0.2%, and Commercial Vehicles (CV) by 1.3%.

CY’23 Auto Retail Performance

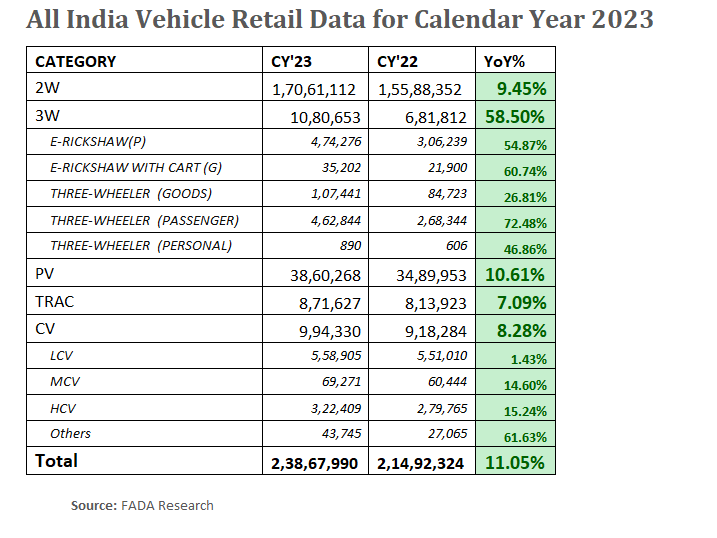

The entire Calendar Year (CY) ’23 demonstrated significant growth, with an overall increase of 11% YoY. Growth was recorded across all segments: 2W grew by 9.5%, 3W by 58.5%, PV by 11%, Tractors by 7%, and CV by 8%.

Impact of the Kharmas Period

The inauspicious Kharmas period, from 16th December 2023 to 15th January 2024, is anticipated to lead to a period of slower demand.

Inventory Levels Across Categories

While the 2W category maintains an optimal level of inventory, the Passenger Vehicle (PV) category continues to face challenges with high inventory levels, despite a slight decline observed at the end of December.

Near-Term Outlook for Auto Retail

The near-term outlook for the auto retail sector remains positive, with a focus on launching new models and tackling the challenge in inventory management in the PV category.

Prospects for CY’24 in Auto Retail

Buoyed by the rebound in consumer sentiment as indicated by the December 2023 CMIE Index, the forecast for CY’24 in the auto retail sector is positive.

Strategic supply and inventory management are emphasized as critical for leveraging the upcoming trends.

Commenting on December’23 and CY’23 Auto Retails, FADA President, Manish Raj Singhania, said, “December’23 was an overall good month for Indian Auto Retail, as total retails during the period saw a growth of 21% YoY. All categories closed in green, with 2W, 3W, PV, Trac, and CV growing on a YoY basis by 28%, 36%, 3%, 0.2%, and 1.3%, respectively.

Similarly, for CY’23, the year ended with double-digit growth as total retails during the year saw an increase of 11% YoY. Here also, all categories closed in green, with 2W, 3W, PV, Trac, and CV growing on a YoY basis by 9.5%, 58.5%, 11%, 7%, and 8%, respectively.

In the 2W category, key drivers included an abundance of marriage dates and the distribution of harvest payments to farmers, which enhanced purchasing power. Additionally, the availability of a wide range of models and variants, coupled with favorable weather conditions and a generally positive market sentiment, contributed to this robust growth. Enhanced product acceptance, particularly among the youth, and lucrative financial options, coupled with the anticipation of price increases in January 2024, spurred purchases.

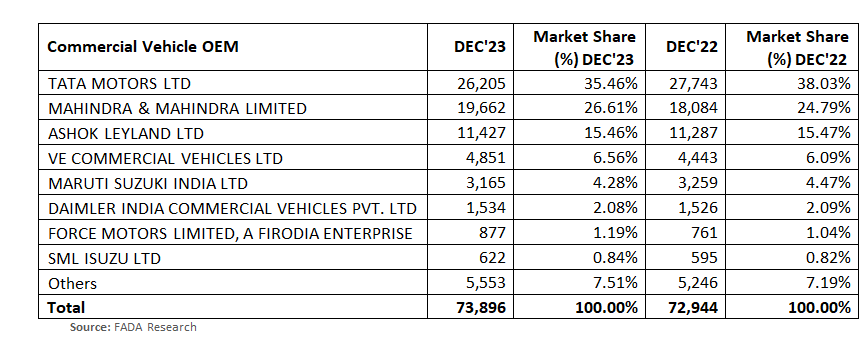

The CV category experienced positive growth as increased industrial activity and infrastructure development continued to fuel demand for M&HCVs. The bus segment also saw a rise, particularly in tourism and transportation, aided by orders from various state transport departments. Additionally, robust liquidity in rural areas and the financial boost from crop sales supported customer purchases, although retail cases remained somewhat subdued despite some pre-buying in bulk.

In the PV category, SUVs, in particular, saw strong demand, with extended waiting periods for key models. This surge was fueled by aggressive year-end promotions and the introduction of new models. However, a significant concern was the high inventory levels, reflecting oversupply. This ongoing issue of high PV inventory, despite a slight decrease by the year’s end, remains a critical area for OEMs to address, emphasizing the need for further moderation in inventory management.”

Short-Term Outlook

For January 2024, the auto retail sector displays a cautiously optimistic outlook across 2W, CV, and PV categories:

2W: The sector anticipates a positive trend post mid-January, with all models available and increased marketing efforts. The upcoming election is expected to stimulate spending in this category. Improved customer sentiment, buoyed by factors like good crop prices and potential fuel price reductions, should enhance demand. Festivals and a robust marriage season are also likely to contribute to increased sales.

CV: January is poised for growth with strong demand continuing, especially after mid-January. Good advance bookings and positive market sentiments, coupled with government policies and infrastructural projects, are expected to bolster sales. The passenger carrier segment, in particular, shows promise with increased rural mobility with good highways now in place.

PV: The focus will be on clearing pending bookings and launching new 2024 models. Despite concerns over high inventory levels and the impact of year-end discounts, positive market sentiments and the introduction of new models are likely to drive growth. However, challenges remain in terms of supply constraints for higher variants and shifting consumer demands towards SUVs.

In summary, the Kharmas period, extending from 16th December’23 to 15th January’24, is forecasted to bring about a phase of reduced demand. Despite this anticipated slowdown, the industry maintains a stance of cautious optimism, buoyed by the launch of new models which are expected to sustain a high level of market enthusiasm. It is imperative to focus on the effective management of supply and inventory, particularly in the PV category. This strategic approach will be a critical factor in determining the industry’s success during this upcoming period. Furthermore, an increase in the interest rates for auto retail finance could potentially act as a moderating factor in market dynamics.

Long-Term Outlook

For CY’24, the auto retail sector anticipates a positive trajectory across categories:

2W: The sector expects a boost from new model launches, especially in the first half of the year, and an overall better economic condition coupled with higher EV participation. Improved customer sentiments, due to factors like lower fuel prices and crop payments to farmers, are likely to drive demand.

CV: A positive outlook is driven by expectations of increased government spending due to elections, infrastructural projects, and demand in key industries like coal, cement, and iron ore. The market is also expected to benefit from the replacement of older vehicles.

PV: PVs are expected to see growth with new product launches and stable market sentiments. The market is hopeful about improved vehicle availability and demand driven by new models with many OEMs launching their EVs. However, caution should be exercised regarding excess inventory as well as the need to match production with actual market demand.

In light of the recent developments, the Indian consumer sentiment, as indicated by the CMIE Index of Consumer Sentiments for December 2023, has shown a remarkable rebound, reaching levels unseen since before the national lockdown in March 2020. This index has now eclipsed the figures last observed in February 2020, just a month prior to the government’s imposition of the lockdown aimed at containing the Covid-19 pandemic. With this resurgence in consumer confidence, the forecast for CY’24 is decidedly optimistic. Each sector within the auto retail industry is positioned for growth, navigating through the dynamic market conditions. Nonetheless, the pivotal role of meticulous supply and inventory management cannot be overstated. These elements will be key in fully leveraging the positive trends that the new Calendar Year promises.