Through a connected approach, the company is quietly building what the aftermarket never had — a unified digital backbone for parts, repairs, and transparency.

Autorox, a SaaS platform that gives independent garages the same digital muscle as large dealership networks, is steadily expanding its role in the automotive ecosystem. The company has begun working with insurance firms to enable claims processing directly through its platform. Serving over 2,000 workshops, Autorox has built a strong footprint across 30 countries—led by India, its largest market—along with growing presence in the Middle East, Africa, Southeast Asia, and parts of Europe.

Mr. Vijay Gummadi, Founder & CEO of Autorox, knew that scaling through insight, speed, and smart architecture was the leanest path — but he also realised early that taking an India-built solution global would be far from easy. Every market speaks a different language, follows different processes, and has its own gaps in the aftermarket. So, he adopted a simple rule: listen first, build next.

When entering a new country, the company starts by understanding what local workshops struggle with — whether their current systems are outdated or missing key features. Instead of long development cycles, they quickly share mock-ups and improved versions to show how the product can solve those specific problems. These back-and-forth builds trust fast. At the same time, the product itself matures to match the needs of that region. Once a few early customers come onboard, these workshops become references, helping the company expand organically.

The platform’s architecture also makes scaling easier. Everything is plug-and-play — from integrating local payment systems to connecting with regional spare parts suppliers. What works with PayU or Razorpay in India can be replaced with a local equivalent elsewhere without rebuilding the system, he said.

In India, Autorox primarily supports multi-brand, independent workshops and large service networks — from small mom-and-pop garages to 500-outlet chains like Bosch Car Service. Abroad, the platform is even used by authorised dealers, including Toyota in Africa and Europe, where OEMs sometimes don’t offer dealer management systems. The same software also powers 2-wheeler and 3-wheeler workshops, heavy and light commercial vehicle service centres, and even EV repair shops, he noted.

The Genesis

Building technology for the global auto aftermarket sounds exciting from the outside, but inside, it’s a maze of fragmented workshops, low digital awareness, and almost no standardisation. The journey began with a simple advantage — Mr. Gummadi understood two worlds well: fixing cars and writing code. That rare mix shaped everything that followed.

After running a tech company in the U.S. and later building a chain of vehicle repair workshops in India for nearly a decade, he saw the ecosystem up close — the customer pain points, the struggles of parts suppliers, and the gaps in technician skills. These insights became the foundation of a platform originally built just for internal use, designed to connect all five pillars of the repair ecosystem: vehicle owners, workshops, spare parts suppliers, insurers, and fleet operators.

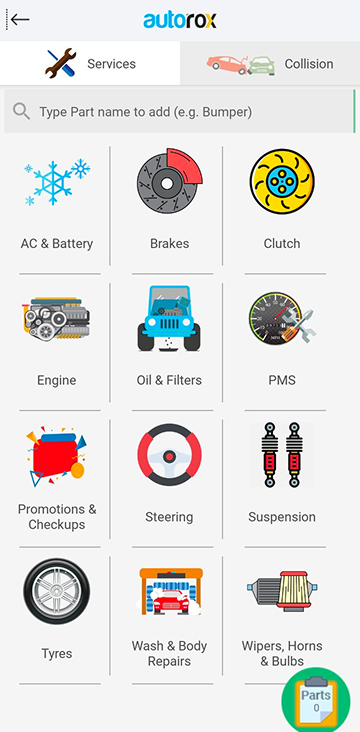

Entering the wider market brought a new set of challenges. Independent workshops often resisted technology, saying they didn’t need it. So, the approach shifted: instead of forcing complex tools, the team built technology that felt “amazingly simple.” Visual interfaces, icons, and photographs made the software usable even for those with minimal tech exposure. Onboarding became effortless — a service advisor could start using it within four hours.

The system also adapts to the brand being serviced. If a workshop handles a Honda, the software feels Honda-specific; if it’s a Toyota, it responds accordingly. Relevant parts, labour, and service details auto-populate, eliminating the need for manual searches.

Years of learning from independent repair shops shaped this evolution. The goal was clear: technology should feel natural, useful, and built for them. And that simplicity — born from deep industry experience — has become the platform’s greatest strength, he said.

Bridging Workshop Reluctance and Customer Expectations

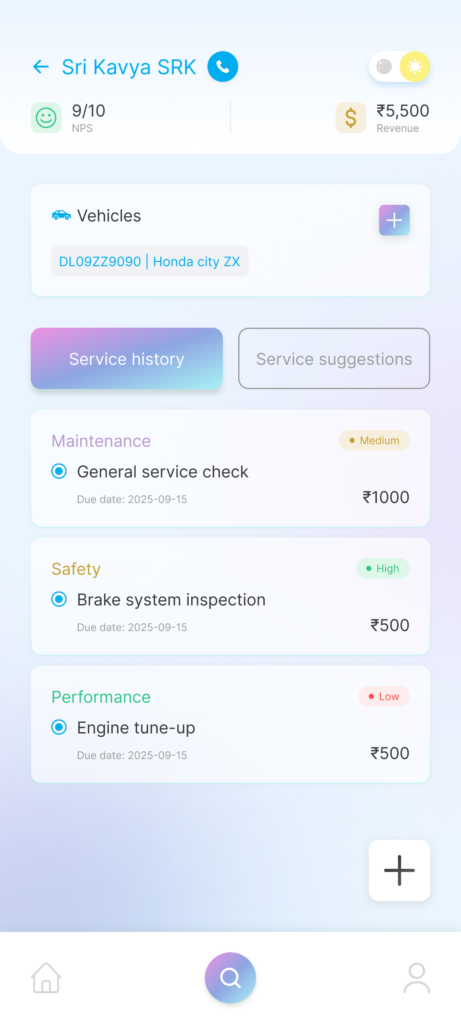

According to Mr. Gummadi, winning over workshops while meeting the rising expectations of digitally savvy customers was one of the toughest challenges. Car owners wanted quick discovery of reliable workshops, transparent pricing, and real-time updates — but independent garages had never operated that way. There was no “Zomato for car repair,” no simple way to find the right expert, and no culture of timely estimates or open communication. Trust was weak on both sides: customers feared hidden charges and wrong parts, while workshops resisted transparency because it disrupted how they traditionally worked.

To bridge this gap, the Autorox started with a simple idea — solve the problem that mattered most to garages: customer calls. Shops were overwhelmed by repeated status enquiries. So instead of selling a “tech platform,” they introduced an easy tool that automatically sent SMS or WhatsApp updates with photos and repair status. Workshops loved it because it reduced phone calls; vehicle owners loved it because they finally had clarity.

From there, transparency grew step by step. Estimates created in the platform became visible to vehicle owners instantly, who could approve them on the app. Workshops realised they no longer needed long phone discussions. Customers appreciated the honesty. Small wins built trust on both sides, gradually making the solution the largest tech deployment among independent workshops today, he explained.

Reaching this point took patience — almost a decade. In the early years, the team travelled across major cities, meeting garage owners one by one and conducting workshops to build awareness. Today, the shift is remarkable: there are no field teams, no sales calls. Every enquiry is inbound and fully digital. Demos, payments, onboarding, and training — everything now happens online. What once took years of persuasion is today “driven by word of mouth, proof of value, and a growing acceptance that digitisation is no longer optional,” he mentioned.

Connecting Parts, People, and Platforms

The auto repair supply chain is messy, with many layers and almost no digital standardisation, Mr. Gummadi observed. Therefore, the team identified four major gaps: finding the right part, checking who actually has it in stock, managing credit-heavy transactions, and handling last-mile delivery. To solve this, the company built a second platform — Autozilla — to digitise distributors and retailers. It tracks thousands of SKUs, stock levels, warehouse locations, and discount structures through a proper automotive POS system. Unlike generic accounting tools, this gives real-time visibility into what parts are available and where.

Autorox and Autozilla now work together. When a workshop creates an estimate, the system instantly searches across multiple sellers and shows availability and pricing inside Autorox. The workshop can order the part directly, pay online, and get fast delivery — handled through their EV fleet in Hyderabad or through logistics partners like Porter elsewhere. Fulfilment centres support this flow without competing with existing suppliers, keeping the network intact.

To connect workshops, suppliers, insurers, fleets, and even OEM catalogues, the company built strong middleware with a robust API framework. This allows external partners — from service stations to insurance companies — to plug in seamlessly for catalogues, claims, diagnostics, or fleet operations.

Through this connected approach, the company is quietly building what the aftermarket never had — a unified digital backbone for parts, repairs, and transparency.