Improved asset quality to support profitability amid NIM compression

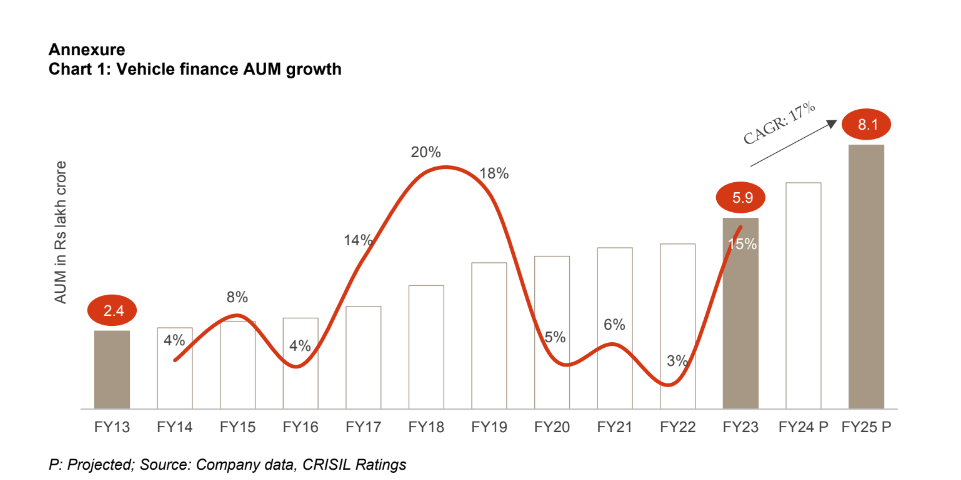

The vehicle financing assets under management (AUM) for non-banking financial companies (NBFCs) are poised to surge to Rs 8.1 lakh crore by March 31, 2025, from Rs 5.9 lakh crore as on March 31, 2023, marking a compound annual growth rate (CAGR) of ~17% (see chart in annexure for details).

Asset quality will continue to improve, too, amidst sustained macroeconomic activity. Consequently, profitability will remain stable, buoyed by declining credit costs, even as higher borrowing costs over the past few quarters could compress net interest margin (NIM).

Growth will be driven by rising demand for commercial vehicles (CVs), cars, utility vehicles (UVs), and two-/three wheelers, accompanied by bigger ticket financing and the government’s focus on infra spending.

CVs hold the lion’s share in vehicle financing AUM, constituting around 50% as on March 31, 2023, followed by cars/UVs at 29%, two-/three-wheelers at 11% and tractors at 10%.

Says Ajit Velonie, Senior Director, CRISIL Ratings, “CV finance is seen growing 12-14% per annum over fiscals 2023-25, propelled by growth in end-user industries such as cement, steel and consumer durables. Financing of cars/UVs and two-/three-wheelers will also see robust growth of 23-25% per annum because of rising sales of premium models and the large-scale replacement volume expected for two-wheelers. Financing of tractors, however, will grow at a relatively moderate pace of 8-10% per annum following uneven monsoon.”

The AUM growth has also been fuelled by used vehicle financing as increasing prices of new vehicles spur demand for used ones. Consequently, the share of used-vehicle financing rose to ~40% from ~33% in the past four years, clocking a CAGR of ~13% vis-à-vis ~4% for new-vehicle financing during the period.

Besides AUM growth, credit profiles of vehicle financiers have also been supported by steady improvement in asset quality since the last fiscal. An analysis of vehicle financiers rated by CRISIL Ratings, accounting for over 90% of the sector’s AUM, indicated that overall 90+ days past due (dpd) improved by ~120 basis points (bps) to 4.7% last fiscal.

Says Malvika Bhotika, Director, CRISIL Ratings, “Given the strong correlation of asset quality with overall economic activity, the overall 90+ dpd should improve by ~50 bps to 4.2% this fiscal and sustain at a similar level next fiscal. The improvement in early bucket delinquencies over the past two fiscals, as reflected in the ~720 bps decline in the 30+ dpd, indicates the same. While improvement is expected across segments, the tractor segment’s asset quality will need to be watched closely, as it is contingent on monsoon patterns, agricultural yields, and rural activity.”

Improved asset quality across major segments will keep overall credit costs under control, supporting profitability. This is despite the expected marginal compression in NIM because of higher borrowing costs.

Interest rate on loans from banks could increase by 25-50 bps owing to recent measures by the Reserve Bank of India (RBI) to increase risk weights for lending by banks to NBFCs. The extent of balance sheet impact will depend on the proportion of bank funding in the borrowing mix and priority sector assets. At the same time, vehicle financiers will need to maintain higher risk weights for top-up loans extended against movable depreciable assets.

That said, the impact of RBI measures on vehicle financiers will be limited. Overall, return on managed assets is projected to remain rangebound at 2.0-2.2% over the next two fiscals.