Abhilash.U

Drawing on four decades of manufacturing depth, service reach and digital capability, Turbo Energy Private Limited (TEL) is strengthening its aftermarket ecosystem as a strategic growth pillar in an industry navigating regulatory shifts, technology transitions and evolving customer expectations. Aftermarket & Service magazine has a detailed exclusive interaction with Mr. Ananth Ramanujam, Executive Vice Chairman, TEL and Mr. P. S. Dasarathy, Executive Director – Operations.

For Turbo Energy Private Limited (TEL), the aftermarket is not an adjunct to the core business – it is a strategic pillar built over decades of manufacturing discipline, service intensity and real-world operating insight. Long before uptime, lifecycle value and digitisation became industry talking points, the company was already investing in systems to ensure that turbocharger-related issues did not translate into prolonged vehicle downtime.

What began as a practical response to limited field expertise has evolved into a structured aftermarket ecosystem spanning authorised service networks, OE-supplied parts, remanufacturing, export markets and adjacent technology applications. This evolution has been shaped by a clear understanding that product quality alone is no longer sufficient – speed of response, diagnostic capability and service reach increasingly define competitiveness in the aftermarket.

As powertrains evolve, regulations tighten and global competition intensifies, TEL’s aftermarket focus reflects a deliberate move to remain relevant across the full vehicle lifecycle, not just at the point of manufacture.

Evolving powertrain realities

Despite ongoing regulatory discussions and global uncertainties, the overall mood within the automotive industry remains cautiously optimistic. According to Ananth Ramanujam, Executive Vice Chairman, the GST moderation implemented in the September–October timeframe has provided a meaningful demand stimulus, particularly for small cars, two-wheelers and three-wheelers, with its full impact expected to materialise over the coming quarters. He noted that sustaining manufacturing growth is critical, adding that the industry is reasonably well positioned to support GDP growth of at least six percent.

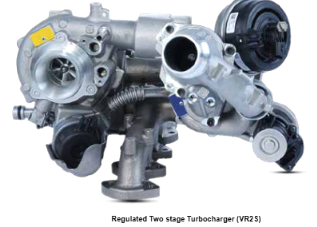

At the same time, policy clarity remains work in progress. While the formal notification of CAFE 3 norms is awaited, early indications around CAFE 4 are already emerging, leading to divided views within the industry. Ananth, however, underlined that the broader direction is unmistakable. “The government’s objectives are very clear – reducing crude oil imports and controlling urban pollution across all major cities. The pathway is clear, even if the transition will demand additional effort from certain segments,” he said.

Aftermarket as a strategic growth pillar

TEL’s aftermarket business has evolved from a service necessity into a strategic growth engine. The company’s journey in the aftermarket began in the late 1990s, initially focused on commercial vehicles at a time when turbochargers were largely replaced rather than service due to limited technical expertise in the field.

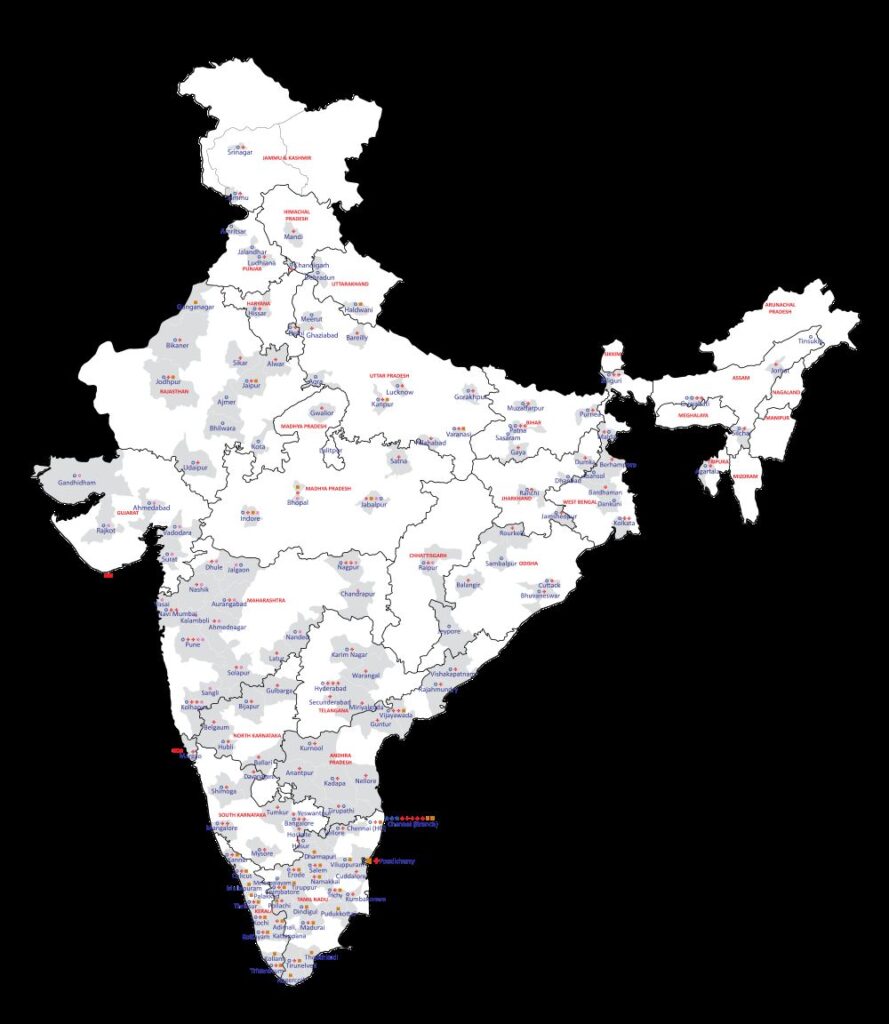

Recognising this gap early, TEL established a franchise-based authorised service model, similar to other global component suppliers. “We started with just a couple of authorised service centres in 1999. Today, we have close to 200 authorised service dealers across the country,” Ananth explained. These centres are trained to diagnose, service and replace turbochargers, while also responding quickly to field complaints.

The emphasis has consistently been on minimising downtime. “A turbocharger may be a component, but for a truck driver, a breakdown means a loss of livelihood for the day. Our philosophy has always been to get the vehicle back on the road as fast as possible,” he said.

TEL’s aftermarket today spans multiple layers – OE-supplied aftermarket parts, an independent aftermarket serviced through authorised centres, remanufacturing, and select export markets. While independent aftermarket demand continues for older BS II, III and IV vehicles, OEM-driven aftermarket parts have emerged as a fast-growing segment. Ananth pointed out that the company’s aftermarket strategy has evolved in line with customer and technology shifts, rather than being confined to a single channel.

TEL sees growth opportunities in South Asia, Africa and Latin America, often following Indian OEMs into these markets. “Where Tata Motors or Mahindra vehicles go, customers expect support from the original turbocharger manufacturer. We have established franchisees in markets like South Africa and Chile to address this need,” he noted.

Uptime, service reach and digitisation

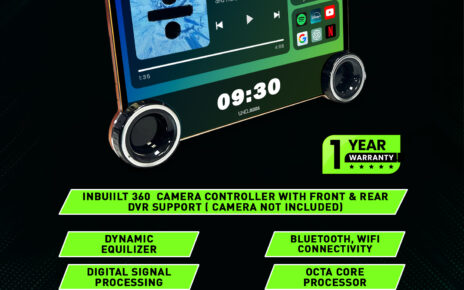

As vehicle architectures become more complex and warranty expectations tighten, the aftermarket is no longer just about parts availability. Digitisation and diagnostics are redefining how suppliers engage with dealers, mechanics and fleet operators. Ananth acknowledged that the growing use of electronic diagnostics and connected systems has raised the bar significantly.

“Unless we can troubleshoot accurately and explain the root cause of failures, warranty settlements become difficult. We are therefore investing heavily in digitisation, tools and training,” he said.

TEL is increasingly positioning itself as a “turbocharger-plus” company in the aftermarket, combining hardware with diagnostic capability and field support. The authorised service network plays a central role here, not only servicing turbochargers but also acting as the first point of contact for any turbo-related issue in the field.

Brand trust has become even more critical as global competition intensifies, particularly from Chinese aftermarket manufacturers. Ananth was clear that this is not a race to the bottom. “If we can offer a premium-quality product with the responsiveness and flexibility of a mid-market supplier, we can capture a significant part of the market without compromising on value,” he said.

Manufacturing depth and circular economy advantage

TEL’s aftermarket strength is closely tied to its manufacturing philosophy. P. S. Dasarathy, Executive Director – Operations, emphasised that the company makes no distinction between OEM and aftermarket quality.

He identified three core strengths that have sustained TEL over nearly four decades – global-standard product capability, extreme vertical integration, and a dense service network. “Within a 10-kilometre radius of our plant, most of the turbocharger components are manufactured – casting, machining, assembly, everything. Very few turbo manufacturers globally can claim this level of integration,” Dasarathy stated.

This integration enables TEL to play a meaningful role in the circular economy. Old turbochargers collected through the service network are being remanufactured and sold thru aftermarket network. “

To address the high-mix, low-volume nature of aftermarket demand, TEL operates a dedicated aftermarket manufacturing facility. This unit handles hundreds of part numbers each month, some with volumes as low as a few units. “This cannot be run like a high-volume OEM line. It needs a different mindset, tighter control and consistent quality,” Dasarathy explained.

A notable feature of this facility is its women-led workforce, operating in day shifts. “These operations require precision and focus. The team follows instructions meticulously, without the pressure of night shifts. It has improved quality, engagement and gender diversity within the organisation,” he added.

Advanced capabilities such as sand 3D printing, CT scanning and reverse engineering further strengthen TEL’s aftermarket responsiveness.

Future readiness beyond the core turbocharger

Looking ahead, TEL is actively extending its core competencies into adjacent applications. Energy-efficient e-blowers developed for wastewater treatment and e-compressors for fuel-cell applications are examples of how the company is rethinking the turbocharger as an air-handling solution rather than a product limited to internal combustion engines.

“At its core, a turbocharger is an air-supplying machine. Once you change that perspective, new applications open up,” Dasarathy said, noting that these projects also align with broader ESG and sustainability objectives.

Currently, the aftermarket contributes around 10 percent of TEL’s overall revenue, but its strategic importance is growing steadily. Ananth believes structural shifts in the industry will further elevate this share over time. “With the longevity of internal combustion engines in commercial, off-highway and tractor applications, the aftermarket will continue to sustain our growth for many years,” he said.

While challenges remain – particularly around fill rates, diagnostics and execution speed – both leaders are confident these are manageable. As Ananth summed up, the aftermarket is no longer a peripheral activity for TEL, but a long-term pillar built on manufacturing depth, service reach and digital readiness, quietly positioning the company for sustained relevance in a rapidly evolving mobility ecosystem.