As mobility grows smarter, the company is equipping India’s aftermarket with the skills and technology needed to stay ahead—ensuring every vehicle stays on the road, reliably and safely.

The aftermarket world is changing fast as vehicles become electric and software-driven, and ZF believes this shift brings both challenges and new possibilities. The rise of software-defined vehicles (SDVs) will simplify some hardware, especially controllers, and reduce a few friction-heavy parts. But it won’t shrink the aftermarket dramatically. In fact, new electronic and software-linked components will appear as vehicle architectures and evolve over the next several generations, Mr. Philippe Colpron, Global Head – Aftermarket, ZF Group observed.

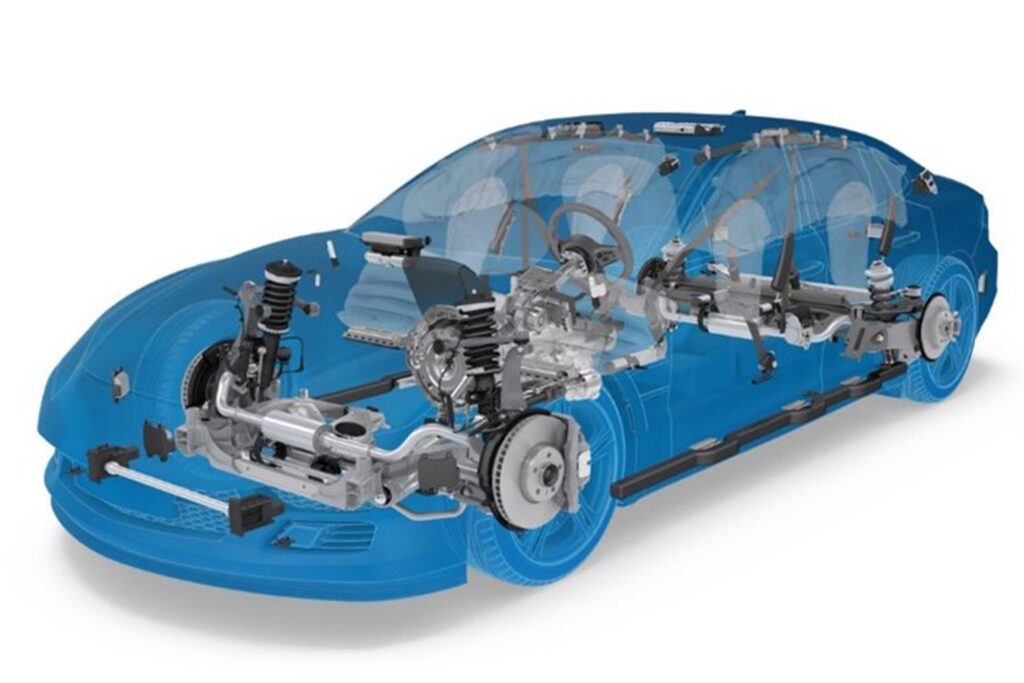

Speaking to this publication, he said, ZF’s view is simple: vehicles may change, but the core functions they rely on don’t. Every vehicle—electric, combustion or software-defined—will still need braking, steering, damping and suspension. These “chassis parts remain the heart of the company’s aftermarket strength and will continue to dominate replacement demand,” he said.

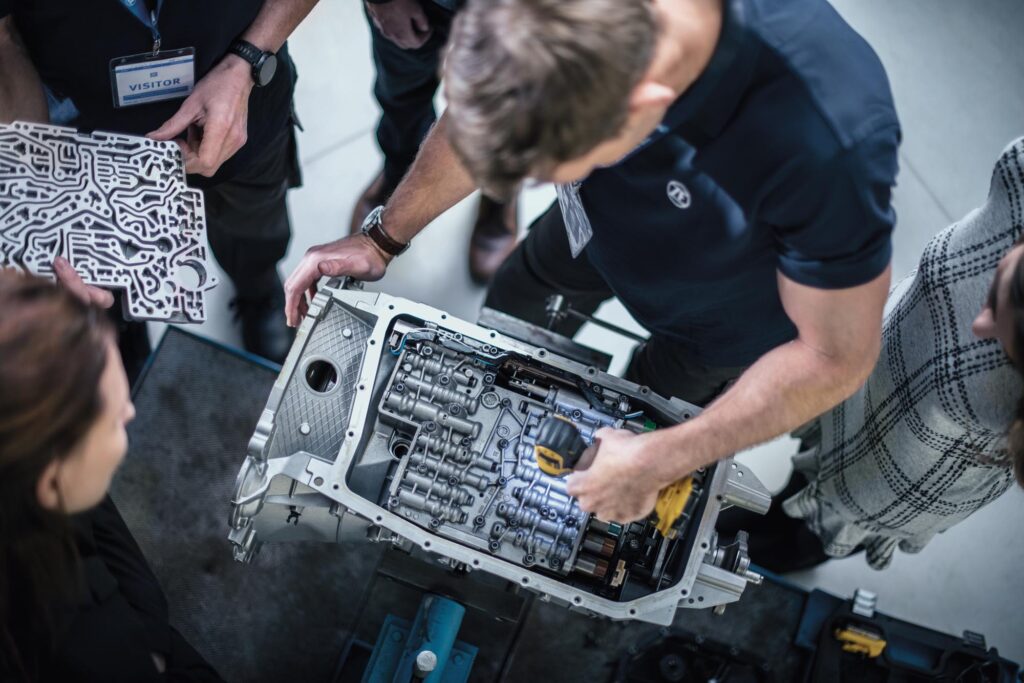

At the same time, the company is preparing workshops for both today and tomorrow. Whether it’s clutches, transmissions or EV drivetrains, the company aims to support legacy systems while helping partners transition to newer technologies. With growing diagnostic and software capabilities, the company wants to stay a strong, reliable player through every stage of the industry’s transformation.

Navigating the Software Shift

As vehicles become more software-driven, the aftermarket is changing across passenger cars, commercial vehicles and even farm and mining machines. Each segment uses software differently—cars focus on driver comfort, commercial vehicles on coordinated transport operations, and agricultural equipment on precise automated tasks. But all of them share one growing trend: more mechatronics and more components controlled by software signals.

For workshops, this means the days of purely mechanical repairs are over. Even something as simple as changing brake pads can now require a diagnostic tool, he pointed out. With vehicle models becoming more complex, no garage can afford licences for every system on the market. This is where ZF steps in with digital tools like Pro Diagnostic and MultiScan, helping mechanics handle multiple vehicle types in a practical, cost-efficient way.

With more software comes more data—and more responsibility. Mr. Colpron stressed that safety and cybersecurity are core priorities. As parts evolve from mechanical to cloud-connected mechatronic systems, keeping the entire chain secure becomes crucial. The company uses its strong Tier-1 expertise to offer the independent aftermarket tools that are both safe and affordable, bridging the gap between modern vehicle technology and everyday workshop needs.

Making Sense of Vehicle Data

As vehicles become smarter, they generate huge amounts of data—and this raises a big question in the aftermarket: who really owns that data? The answer isn’t simple. It varies by region, by type of data and by who needs it. He explained that vehicle data can mean many things: personal data about the driver, technical data about how the vehicle operates, system data needed by suppliers, or logistics data used by fleet operators. Each type needs to be treated differently.

In regions like Europe, data privacy laws are already strong. Policymakers are working on clear rules that balance three important needs: protecting personal data, ensuring cybersecurity, and keeping the “right to repair” open, so mobility doesn’t get restricted by monopolies. Other markets, including India, are moving in the same direction, each at its own pace, he mentioned.

ZF sees one thing as essential for society: vehicles must stay repairable. If only OEMs controlled all the data, independent workshops would struggle to function—and mobility would slow down. That’s why the industry broadly agrees on supporting fair access to repair and diagnostics, so that vehicles remain on the road and customers continue to have choice, he mentioned.

India’s Rise in the ZF Aftermarket Story

ZF’s aftermarket business is evolving quickly, both globally and in India. The company sees its mission in simple terms: keep vehicles running, keep mobility reliable, and support every partner in the ecosystem—from distributors to workshops to drivers.

Over the past year, ZF has focused on three key areas. First, strengthening its partnerships and building trust across markets. Second, expanding and modernising its product portfolio with stronger brands and digital tools. Third, connecting the entire ecosystem through better logistics, service networks and digital touchpoints.

According to Mr. Colpron in India, ZF’s presence has grown steadily over six decades. The company now operates in over 250 cities and continues to deepen its reach by improving logistics, widening its product range and expanding ZF (pro) Tech workshop network. Strong local teams help it stay close to customers while India’s talent pool supports global functions ranging from software and customer service to product management and manufacturing. Many products made in India are now exported worldwide.

ZF sees mobility as a basic need—essential for daily life, business and even emergency services. As the aftermarket faces rapid change, the company’s goal is to help partners stay ahead through better training, digital diagnostics, wider portfolios and strong supply chains. However, one challenge remains: more vehicle models mean more parts to stock, making inventory management harder. The company tackles this through two approaches, he said. First, it rapidly expands its catalogue—adding about 12,000 new part numbers, almost every year to ensure high coverage for new vehicles. Second, it uses smart engineering to develop universal components that can fit many models, helping distributors reduce stock burden. AI-supported cataloguing and a global logistics network further ensure that the right part reaches the market on time and at the right cost.

Preparing India’s Workshops for the Vehicles of Tomorrow

As vehicles become smarter, more digital and more electric, ZF believes one thing must grow just as fast: the skill of the people who repair them. “Training technicians isn’t an add-on for the company – it’s part of its core identity. Over the past decade, ZF has trained more than a million mechanics worldwide, and India has been a major focus,” he said. Through CSR programmes and fleet-level engagement, the company stays close to the people who keep India’s mobility running every day.

But the company knows training alone is not enough. That’s why ZF (pro) Tech programme goes deeper, giving workshops both hands-on training and the right tools to handle modern vehicles. Today, over 400 workshops across India help mechanics confidently service nearly 35% of a vehicle, including chassis, steering, braking and mechatronic systems. With more software, electrification and complex electronics entering vehicles, this support will only become more critical in the coming years.

Artificial Intelligence (AI) is also becoming a quiet but powerful force behind ZF’s aftermarket strategy. The company is using AI to make diagnostics simpler, guided repair faster and technical answers easier to find. It’s even helping inside its own factories, where AI now supports remanufacturing processes such as sorting used cores, improving efficiency and quality. For mechanics and workshops, these innovations mean fewer uncertainties, quicker problem-solving and better readiness for next-generation vehicles, he signed off.