The Automotive Component Manufacturers Association of India (ACMA) – the apex body representing India’s auto component manufacturing industry – has released the findings of its Industry Performance Review for FY2024–25.

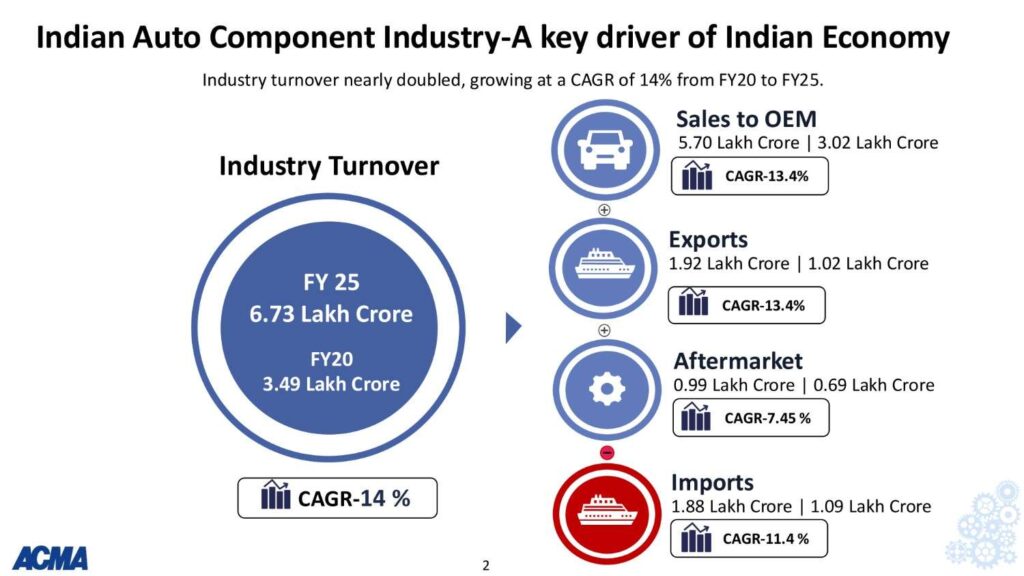

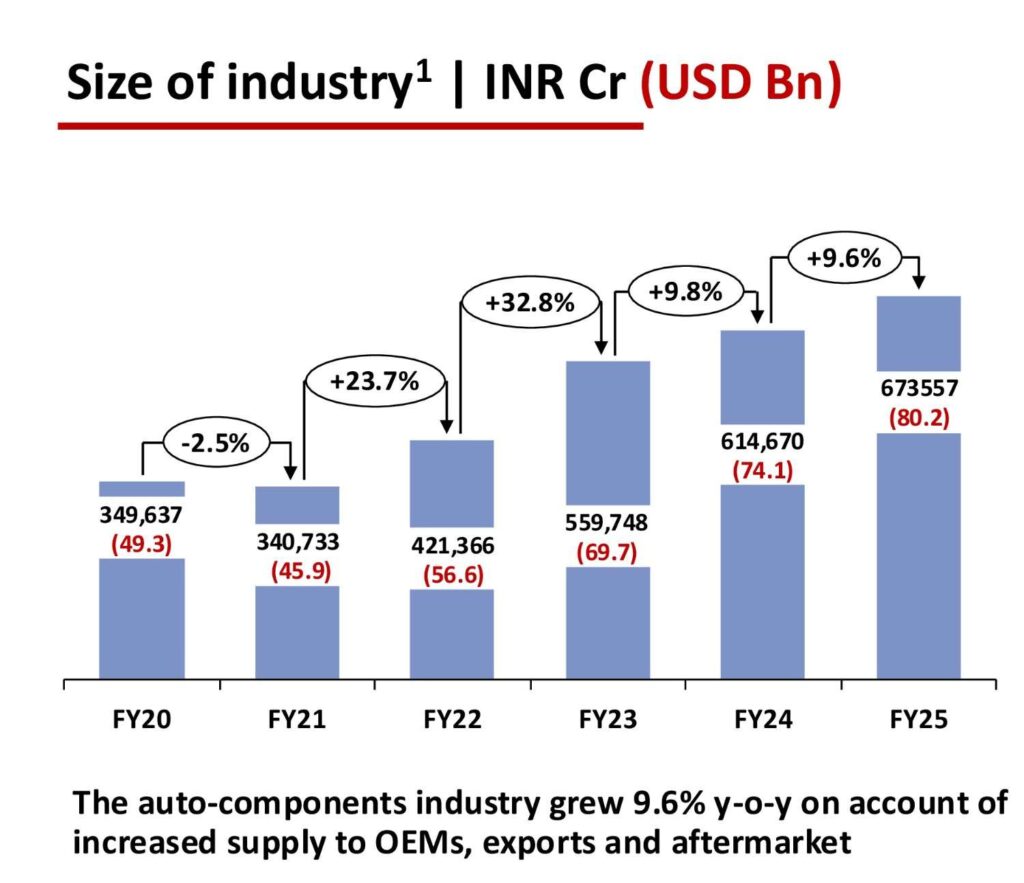

According to the report, the Indian auto component industry recorded a turnover of ₹6.73 lakh crore (USD 80.2 billion), reflecting a year-on-year growth of 9.6%. Over a five-year horizon, the industry has grown at a compound annual growth rate (CAGR) of 14%, nearly doubling in size from FY2020 to FY2025.

Growth Across All Segments

Commenting on the industry’s performance, Vinnie Mehta, Director General, ACMA, said:

“The Indian auto component industry continues to demonstrate remarkable resilience and growth. With positive momentum across OEM sales, exports, and the aftermarket, the industry clocked a turnover of ₹6.73 lakh crore (USD 80.2 billion) in FY25 – a 9.6% growth over the previous fiscal. The trade surplus stood at USD 453 million, underscoring India’s growing manufacturing competitiveness and localisation initiatives. The aftermarket, estimated at ₹99,948 crore, grew by 6%, while component supplies to domestic OEMs rose 10% to ₹5.7 lakh crore.”

Sharing her perspective, Shradha Suri Marwah, President, ACMA & CMD, Subros, said:

“The Indian auto component sector remains a cornerstone of the country’s manufacturing strength. FY25 marked another milestone year, with growth fuelled by robust domestic demand, rising exports, and increasing value addition. As the country pivots towards new-age mobility, our industry is making the required investments in technology and localisation to serve both domestic and global markets more effectively.”

Elaborating on industry sentiment and the road ahead, she added: “FY25 witnessed broad-based growth across segments. Two-wheelers performed strongly, while passenger and commercial vehicles maintained steady momentum. On the exports front, geopolitical challenges led to supply-chain disruptions. Still, the industry remains resilient and in sound health. There is increasing focus on technology upgradation, higher value-addition, and deeper localisation. However, limited availability of rare-earth magnets is a growing concern, highlighting the need for a national critical materials strategy to secure the future of India’s EV and mobility manufacturing ecosystem.”

Key Findings from ACMA Industry Performance Review – FY2024–25

Sales to OEMs

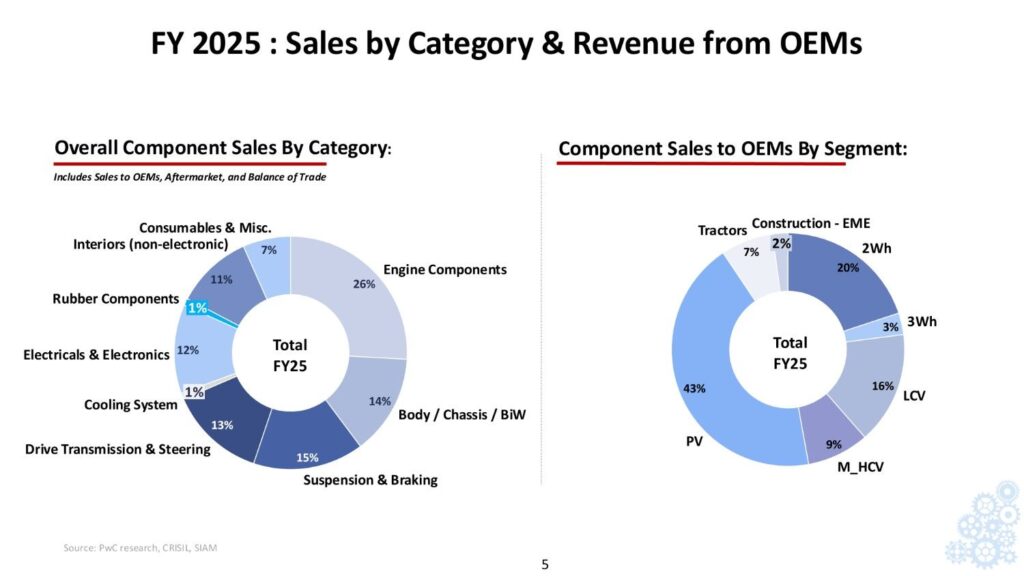

Component supplies to OEMs stood at ₹5.70 lakh crore, registering 10% year-on-year growth, driven by an 8% increase in overall vehicle production. Greater value-addition and a market shift towards larger, more powerful vehicles also contributed to this growth.

Exports

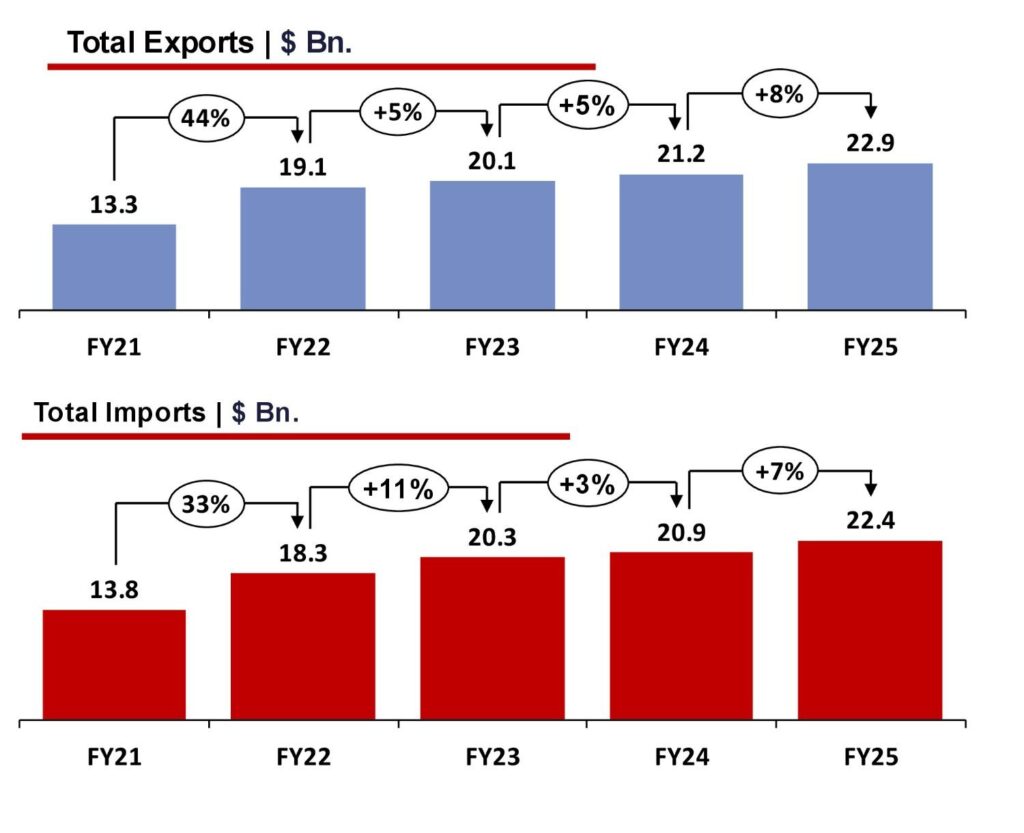

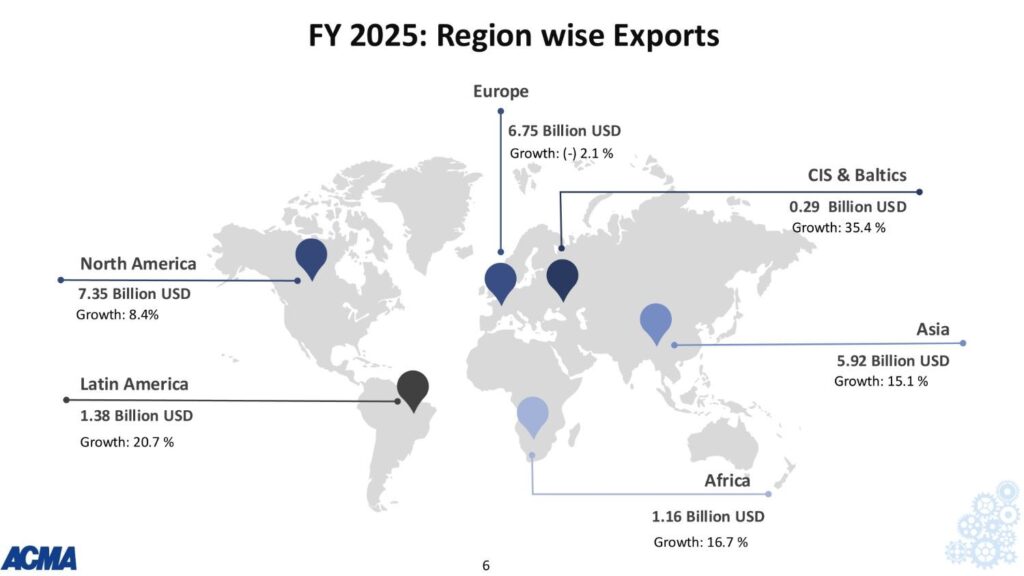

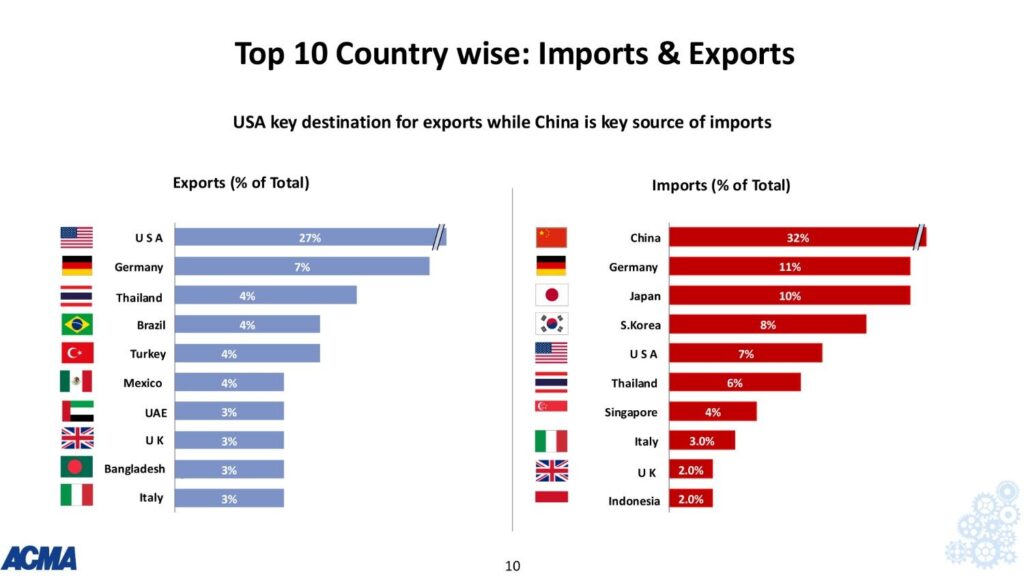

Auto component exports grew 8% to USD 22.9 billion (₹1,92,346 crore), up from USD 21.2 billion (₹1,75,960 crore) in FY24.

- North America (32% share) grew 8.4%

- Europe (29.5% share) declined 2.1%

- Asia (26% share) posted 15.1% growth

Top export categories: Drive transmission & steering systems, engine components, suspension, braking, and body/chassis parts.

Imports

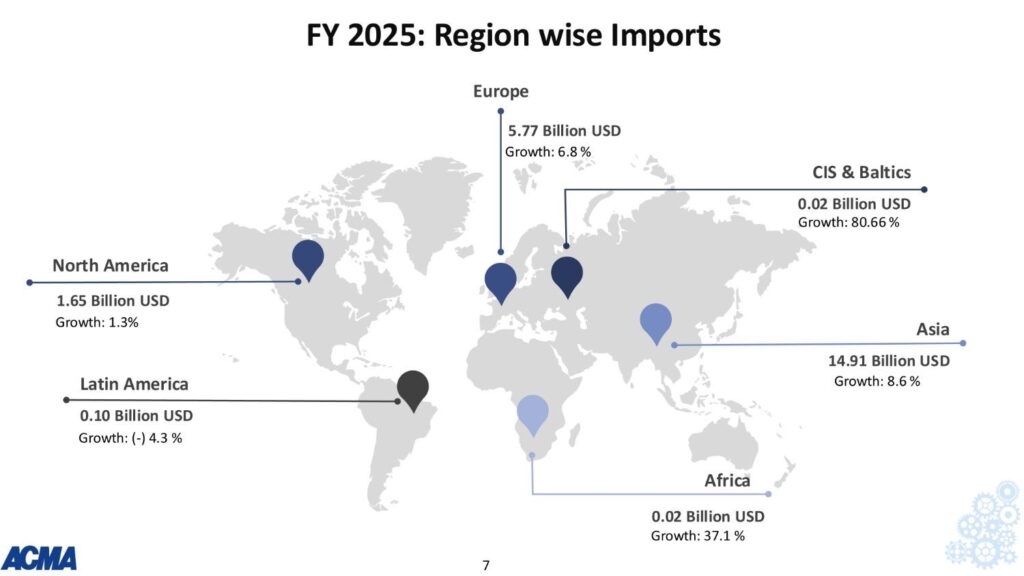

Imports increased by 7.3% to USD 22.4 billion, with Asia accounting for two-thirds of the total.

The trade surplus rose to USD 453 million, up from USD 300 million in FY24 – signalling enhanced global competitiveness and stronger localisation.

Aftermarket

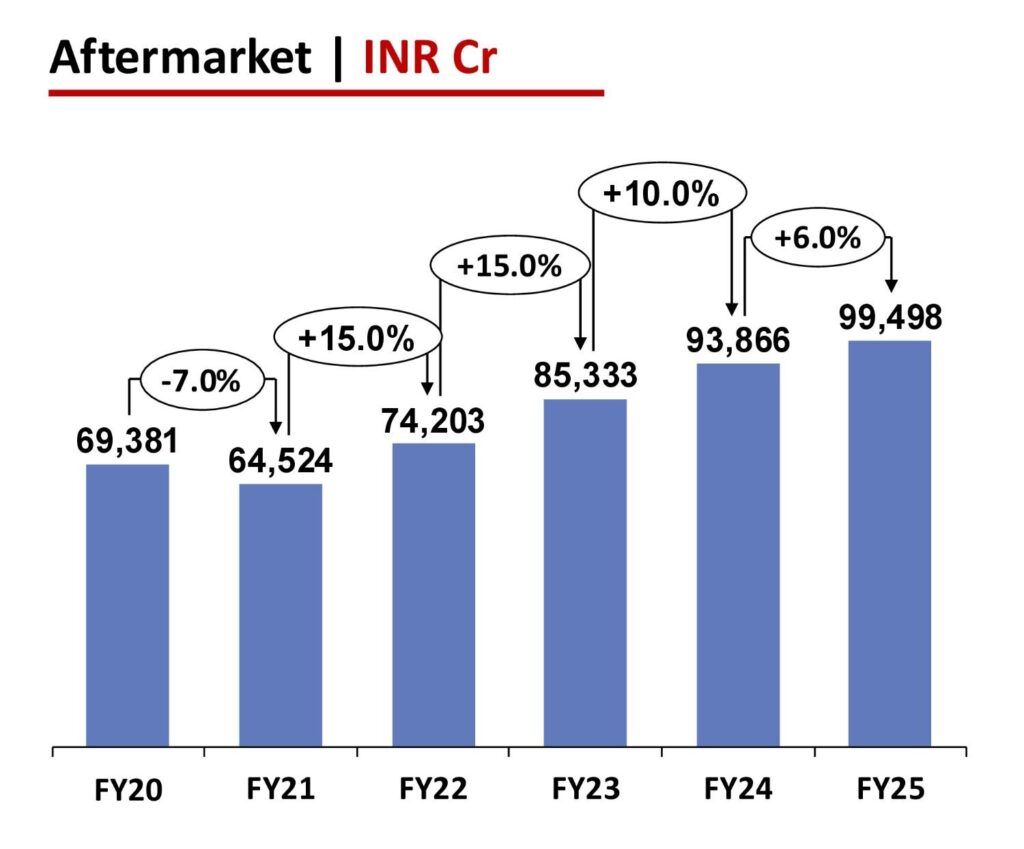

The aftermarket segment grew 6% to ₹99,948 crore (USD 11.8 billion), supported by:

- An expanding used vehicle population

- Formalisation of the repair ecosystem

- Stronger rural demand aided by e-commerce penetration

Notes

- Turnover figures represent total supplies from the auto component industry (including ACMA members and non-members) to both on-road and off-road vehicle OEMs and the aftermarket, as well as exports. This includes captive supplies to OEMs and those from unorganised and small players.

- Growth figures for turnover, OEM supply, and aftermarket are in INR terms; export and import growth are in USD terms.

- EV component sales to domestic OEMs are included in OEM supply figures, excluding battery sales.

- Average exchange rate assumed: INR 84/USD (FY25).

- Tyres, batteries, paints, and consumables are excluded from the ACMA industry scope.