Pan-India, Shriram Finance Ltd.

The company follows an inclusive approach that looks beyond salary slips. It considers savings behaviour, existing banking relationships, and the ability to make a suitable down payment.

From metros to remote towns, women today are transforming how mobility is lived and understood. Whether it’s students heading to college, professionals weaving through city traffic, or entrepreneurs reaching customers in small towns, two-wheelers have become a reliable companion—offering freedom, independence, and control over one’s own time. But buying a scooter or motorcycle is still a major investment, and this is where two-wheeler loans make a real difference by turning a big upfront cost into simple, affordable monthly payments.

For many women, a loan isn’t just about convenience—it’s a smart financial choice. Instead of using up savings, they can opt for manageable EMIs, usually between ₹2,000 and ₹5,000, and choose models with better safety, technology, and comfort. Regular repayment also helps build a strong credit history, opening doors to larger loans in the future.

Shriram Finance Ltd plays a key role in supporting this journey, especially in semi-urban and rural areas where access to credit can be limited. Speaking to this publication, Mr. G. M. Jilani, Joint Managing Director and Chief Operating Officer – Retail Finance Business, Pan-India, Shriram Finance Ltd., said the company focuses on trust-driven lending rather than just collateral. By understanding income patterns and offering short, 18 to 24-month loan tenures, Shriram Finance helps women borrowers manage repayments comfortably while offsetting the fast depreciation of two-wheelers. With the right guidance, structured EMIs, and supportive lending practices, owning a two-wheeler becomes not just possible—but empowering for women across the country.

Making Smart Choices before taking the Next Step

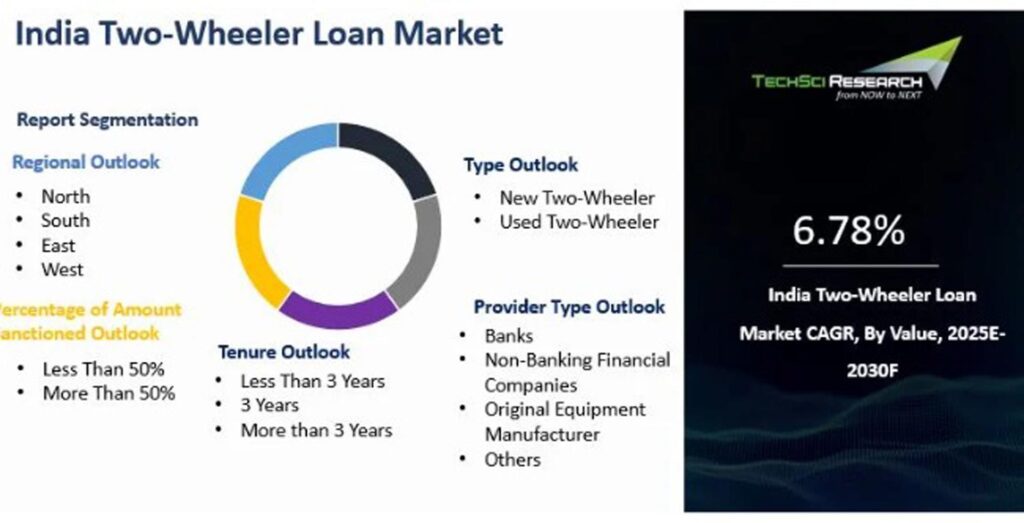

Before applying for a two-wheeler loan, Mr Jilani insisted that women need to look closely at a few important factors to ensure the decision is comfortable, affordable, and truly empowering. The first step is to compare interest rates across banks and NBFCs, as even a small difference can change the overall cost of the loan. Many lenders also provide special benefits for women—such as lower rates or reduced processing fees—making EMIs lighter and savings higher.

Choosing the right loan tenure is equally important: short terms help close the loan quickly but raise the monthly instalment, while longer terms reduce the EMI but increase total interest. Simple online EMI calculators can help women understand these differences by testing various amounts and tenures before making a decision. Checking eligibility norms in advance also avoids delays, as requirements differ for salaried women, self-employed professionals, homemakers, or those applying with a co-applicant.

A good down payment can reduce both the loan amount and long-term cost, though women should also be cautious with zero–down payment schemes that often carry higher interest rates. It is also wise to look for women-centric benefits such as waived fees or simplified documentation, and to read the fine print carefully—especially foreclosure rules, prepayment terms, and penalty charges. Online loan applications offer an easier and faster path, allowing women to compare offers and complete formalities without leaving their daily routine.

Speaking about how Shriram Finance assesses women borrowers, especially those without formal income proof, Mr. Jilani said the company follows an inclusive approach that looks beyond salary slips. It considers savings behaviour, existing banking relationships, and the ability to make a suitable down payment. Women who do not have a regular income can also apply with a co-applicant to strengthen their eligibility. With features like preferential interest rates, low processing fees, and simpler paperwork, Shriram Finance ensures that women across urban and rural India can access credit confidently while the company maintains responsible lending standards.

Reaching Women borrowers where It Matters most

Reaching women buyers—especially in rural and semi-urban areas—comes with its own challenges, from limited financial awareness to hesitation around formal lending. To bridge this gap, Shriram Finance focuses on both access and education. Digital platforms now make it easy for women to check eligibility, compare loan options, and apply online without complicated paperwork. This transparency helps build trust among first-time borrowers. By guiding women through each step and promoting financial literacy, it ensures they can make confident, informed decisions about mobility and money.

In the bigger picture, mobility is more than just getting from one place to another—it is the freedom to manage time, pursue work, and move independently. A well-chosen two-wheeler loan supports these goals without causing financial pressure. When women compare offers, choose the right tenure, plan their down payment, and use women-centric benefits, they not only bring home a scooter or motorcycle—they take a meaningful step toward financial independence. With the right support and a smart loan choice, the road ahead becomes easier, safer, and filled with new opportunities, he added.

Smart Prep helps Self-Employed get Right Used Car Loan: Shriram Finance

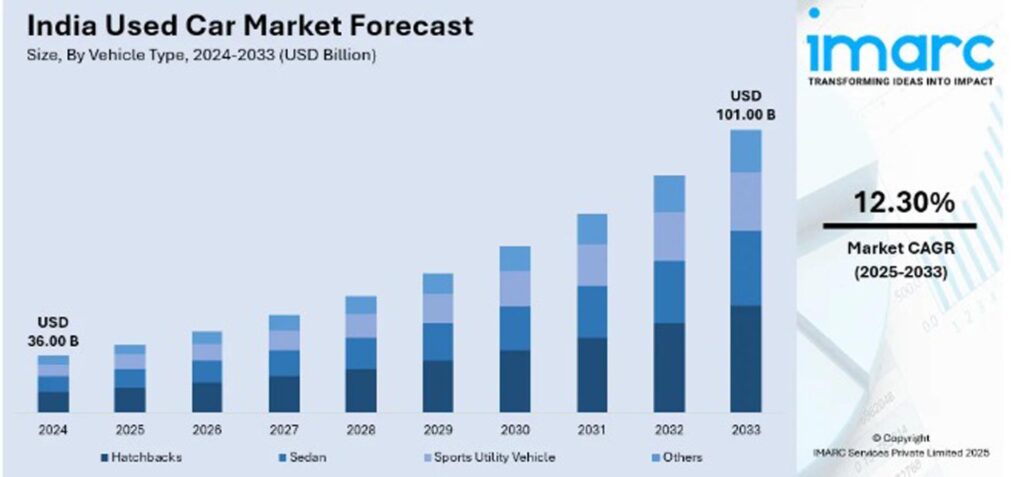

Buying a used car is usually simple for salaried employees — steady monthly pay and clear documentation make lenders comfortable. But for self-employed buyers, the journey often feels less predictable. Irregular income, the absence of salary slips, and the need for multiple financial records mean lenders view them as higher-risk borrowers. Yet, with the right preparation and a clear understanding of what lenders look for, this challenge can be turned into an opportunity.

That’s where Non-Banking Financial Companies (NBFCs) are stepping in to bridge the gap. According to Mr. G. M. Jilani, NBFCs are increasingly relying on alternative markers of income — from GST filings and digital payment trails to steady business invoices — to evaluate repayment ability more accurately. Their strength lies in recognising that while earnings may fluctuate, they can still reflect long-term stability. By using flexible assessment models and reading a wider set of financial signals, NBFCs are expanding credit access for self-employed customers across India.

Pricing used-car loans remains a careful balancing act. As Mr. Jilani explains, lenders must offer competitive interest rates while managing higher risks, rising costs, and tighter margins. Detailed borrower profiling, alternative income checks, and disciplined lending practices help NBFCs maintain portfolio quality without compromising customer value.

For self-employed applicants, preparation makes all the difference. Key documents such as 2–3 years of ITRs, bank statements, profit-and-loss records, business registrations, and a strong credit report can significantly boost approval chances. Strategies like approaching an existing lender with a proven repayment track record, maintaining a healthy credit score, offering a larger down payment, or applying with a stable co-applicant can further strengthen one’s case.

Smarter Valuation, Safer Lending

Mr. Jilani reiterated that valuing a used car correctly is one of the toughest parts of the lending process, especially when hidden issues, tampered odometers, and rapid depreciation can affect the true worth of the vehicle. To keep this process accurate and fair, Shriram Finance combines physical inspection with a deep dive into the car’s past — service history, insurance claims, odometer readings, and overall condition. Market behaviour and depreciation trends for each model are also factored in. By pairing this detailed vehicle assessment with the borrower’s financial stability, especially in the case of self-employed applicants, Shriram Finance ensures that the loan amount is aligned with the car’s real value and that collateral risk remains well under control.

Managing default risk in the self-employed segment requires a different, more nuanced lens. Instead of relying only on traditional income documents, Shriram Finance studies practical indicators like GST filings, digital payment trails, and steady business invoices to understand how money actually flows through the customer’s enterprise. This approach gives a clearer picture of long-term repayment ability, even when monthly cash inflow isn’t uniform. The company also carefully matches vehicle type with borrower profile — for instance, first-time buyers may be guided towards practical, entry-level cars rather than high-end options that could strain repayment, he said.

With the right preparation and a clear understanding of what lenders look for, self-employed individuals can navigate the process with ease. Strong documentation, transparent communication, and choosing a car that suits both personal and business needs can turn what seems like a challenging journey into a smooth path toward ownership.